Investment Return

There are serval different ways to calculate your investment return. Each of them are different in mathematics concept. In this post, I would elaborate the concept and format. After that, you may choose one of them to evaluate your investment.

Cumulative Return

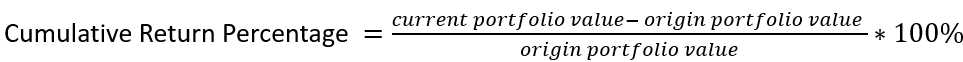

This is the most simply way to calculate your portfolio return. It ignores the time weight of your money. It only considers the current value and origin value of your portfolio. The formula show as follow.

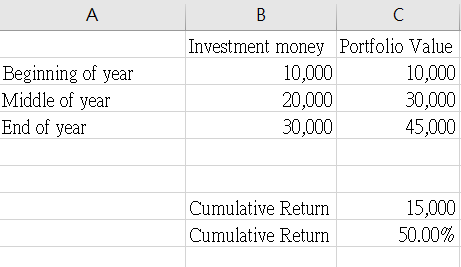

For instance, at the beginning of this year, you invest 10,000 money to A fund. In the middle of this year, you invest 20,000 money to A fund. Then you do not investment money to A fund anymore. Therefore, at the end of this year, your total investment money of A fund in 30,000. Fortunately, A fund current market value is 45,000. Therefore, your return is 15,000 and cumulative return percentage is 50%. For simplicity, you can create a excel work sheet to calculate this kind of return.

Time Weighted Cumulative Return

I show you the simple way of calculate cumulative return of your portfolio in the above example. However, In the reality, the method is not objective. Because investor usually continue to invest capital at different time. The time weight contribution of investment money should be consider. Therefore, this kind of method would give you more detail information of your return.

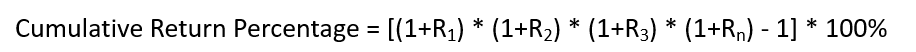

Let start with the formula

Ri is the return rate of different period. This formula show you that the cumulative return rate is composed by different period return rate. For example,

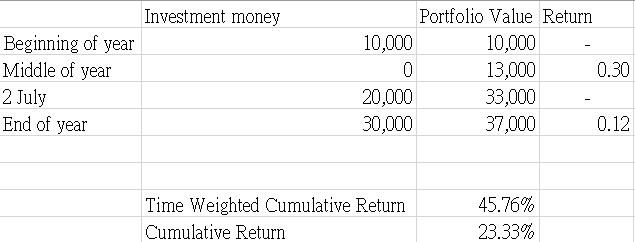

A investor invest 10,000 to A fund at the beginning of this year and the portfolio value becomes 13,000 at the middle of this year. At 2nd July, investor invest 20,000 to A fund. Therefore, the portfolio value should be 33,000 and the total invest capital is 30,000. An the end of this year, the portfolio value becomes 37,000.

So,

R1 = (13,000 - 10,000) /10,000 = 0.3000

R2 = (37,000 -33,000) / 33,000 =0.12

The overall performance of the return should be [(1+0.3 ) *(1+0.12) -1] *100% = 45.76%

However, if we use the simply cumulative return formula. the return should be

[(37,000 - 30,000)/30,000]* 100% = 23.33%

It's because second half year performance is not as good as first half year. Therefore, the cumulative return would under evaluate the overall performance of Fund A. However, if the difference between cumulative return and time weighted cumulative return is large. It indicates that the stability of your performance is low. The return cannot easy to predict.

Same as the cumulative return, I create a work sheet to calculate the return in time weighted method too.

Capital Weighted Cumulative Return

Besides time weighted cumulative return, There is another weighted method called capital weighted cumulative return. Compared with the time weighted cumulative return. It is not only consider the time proportion but also capital proportion. Here is what the formula look like.

Ps = Portfolio value at the beginning of the year

Pe = Portfolio value at the end of the year

Ci = Investment capital at the I period

Wti = Time Weight of the investment capital

Wt1 = 1

Wt2 = 11/12

.

.

.

Wt1 = 1/ 12

I assume that the cumulative return is calculated yearly and investor invest a new money to the fund each month. Thus, the time weighted of each new money should be weight monthly and the value is related to the proportion of remaining month at this year.

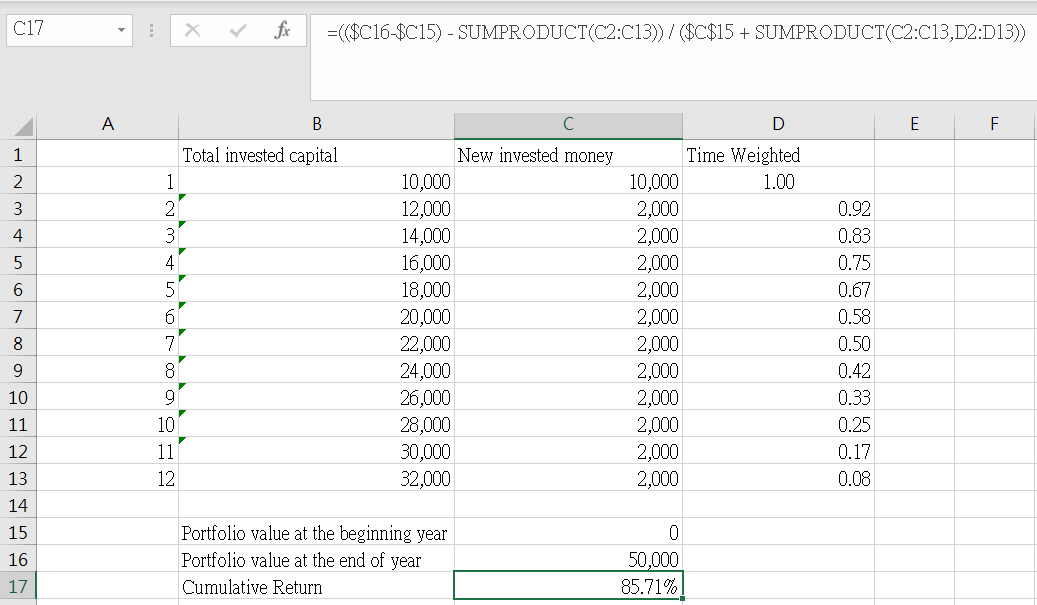

For instance, At the beginning, investor invest 10,000 to fund A and then invest 2,000 to fund A regularly at the beginning of each month. At the end of this year, the portfolio value is 50,000. The return rate be 85.71%. It is greater than the normal cumulative return because the initial invested money should contribute to the return more.

The following picture show the calculation step and formula of capital weighted cumulative return in excel

Summary

In this post, I show you three different ways to calculate the rate or return of your investment. For simplicity, people usually use the first method "cumulative return" to evaluate the profitability of portfolio. For finance specialist, they may want to deeply evaluate the profitability of investment. Therefore, time weighted cumulative return and capital weighted cumulative return methods are both suitable to them. Furthermore, capital weighted cumulative return is more accurate.

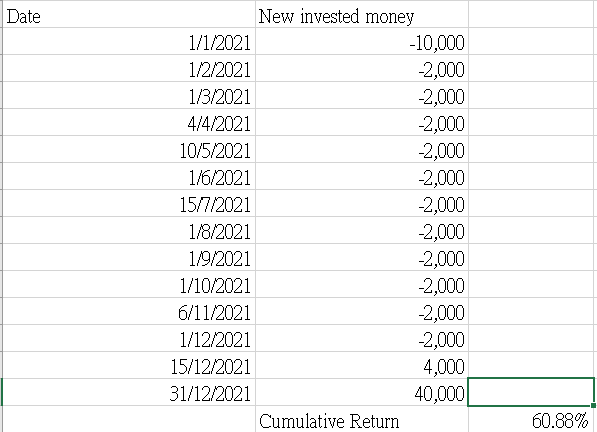

Finally, excel has built in function to calculate capital weighted cumulative return more preciously. It is XIRR function. User must filled in date series and cash flow series parameter in order to get the rate of return. For an investment plan include contribution and redemption. XIRR is better and easy to use.

Here is the example of how XIRR used.

In this example, Investor invest money irregularly and take 4,000 from the portfolio at 15/12/2021. Therefore, the rate of return should be 60.88% at the end of 2021.

The excel file of example I put it on Google Cloud

I hope you enjoy this post.

Please leave your email below.